Bitwala, which wants to launch Germany's first blockchain banking service, has received more than 4 million euros investment under the leadership of Earlybird Venture Capital. Thanks to Bitwala's first crypto-priority service, you will be able to manage your Euro and Bitcoin wallets from your German bank account in November.

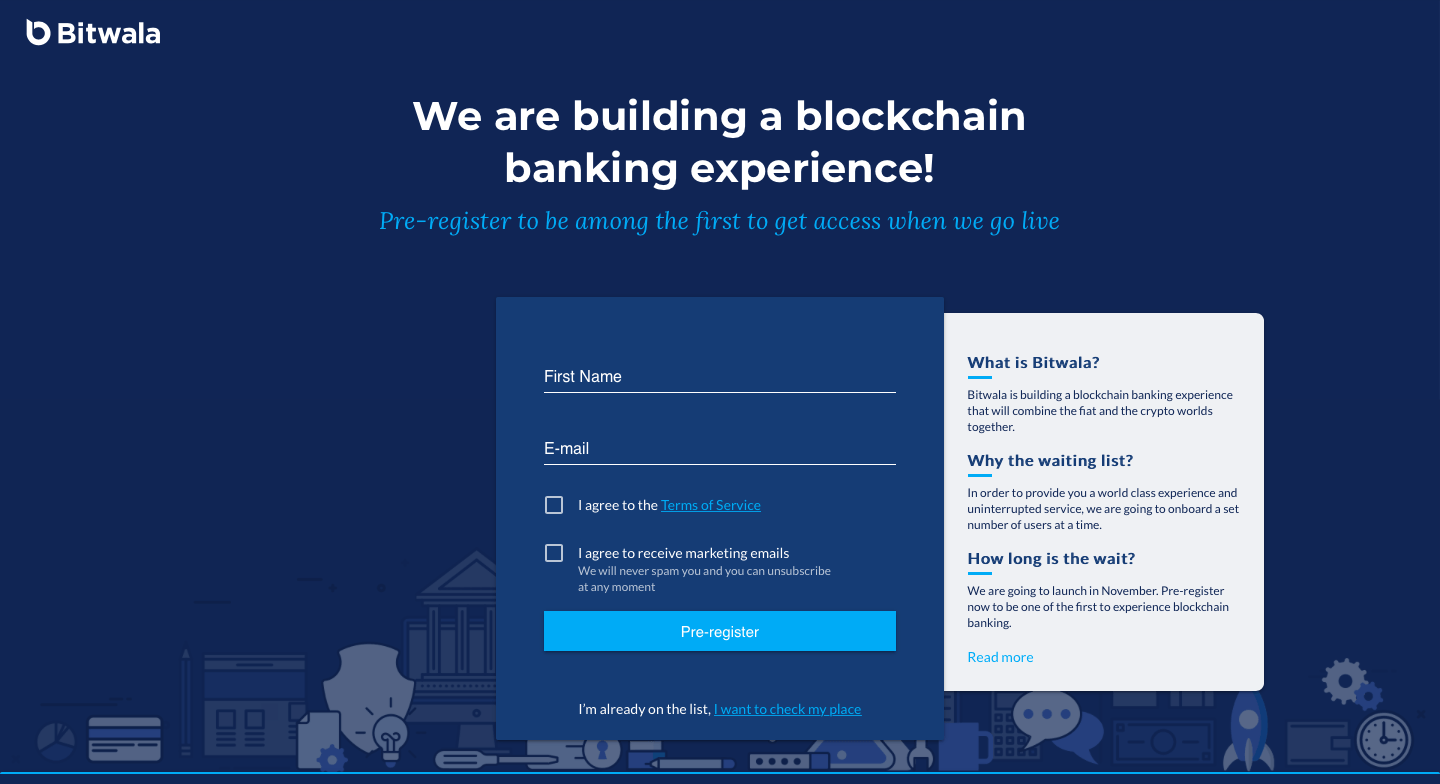

In the meantime, there are more than 30 thousand registered people who want to benefit from this service, that offers a possibility for transitions between Euro and Cryptocurrency. With this funding, users will have the world's first regulated blockchain bank account starting November.

Over the past year and a half, Bitwala has been working on new ways of combining traditional banking with cryptocurrencies. Bitwala establishes the best technique and regulations related to the legislation together with the bank which is their banking partner. At this point, it is useful to say that like Earlybird, coparion invested in Bitwala as well. Apparently; investors trust this original product and the team that put it together. Let's say that with the new investment, product development and growth will gain momentum.

Users can benefit from this system, where daily bank transactions can be done in both in the traditional and the crypto world, through German bank accounts. With Bitwala's banking partner, users will be able to manage SEPA debit and credit transfers, payment management and bank cards on this system. In other words, users can get a salary or pay their rent using Bitwala. In this system, where crypto wallets can be managed as well, it will also be easier to turn cryptocurrencies into cash.

Although Blockchain banking is a new market, Bitwala has a considerable experience in this market. Towards the end of 2017, the company made money transfers by using blockchain as a tool and transferred 100 million Euros for their 80 thousand customers.

With this new product, accounts up to 100.000 Euro are protected in accordance to the German deposit protection regulation. This protection is carried out by BaFin and the Bundesbank, Germany's banking managers.

Would you like to write the first comment?

Login to post comments