Mükellef, gathers digital transformation steps such as online incorporation of company, bookkeeping, e-invoice and e-archive for the entrepreneurs on the same platform. Thanks to public accountants using Mükellef, the companies do not have to depend on outside resources for anything, and manage the whole accounting process on the platform from end to end. Besides, the company helps those without a registered address create an address by offering an 80 percent discount via Sanal Ofis. In short, Mükellef embodies all processes of company incorporation, bookkeeping, e-invoice and public accountancy.

How does Mükellef work?

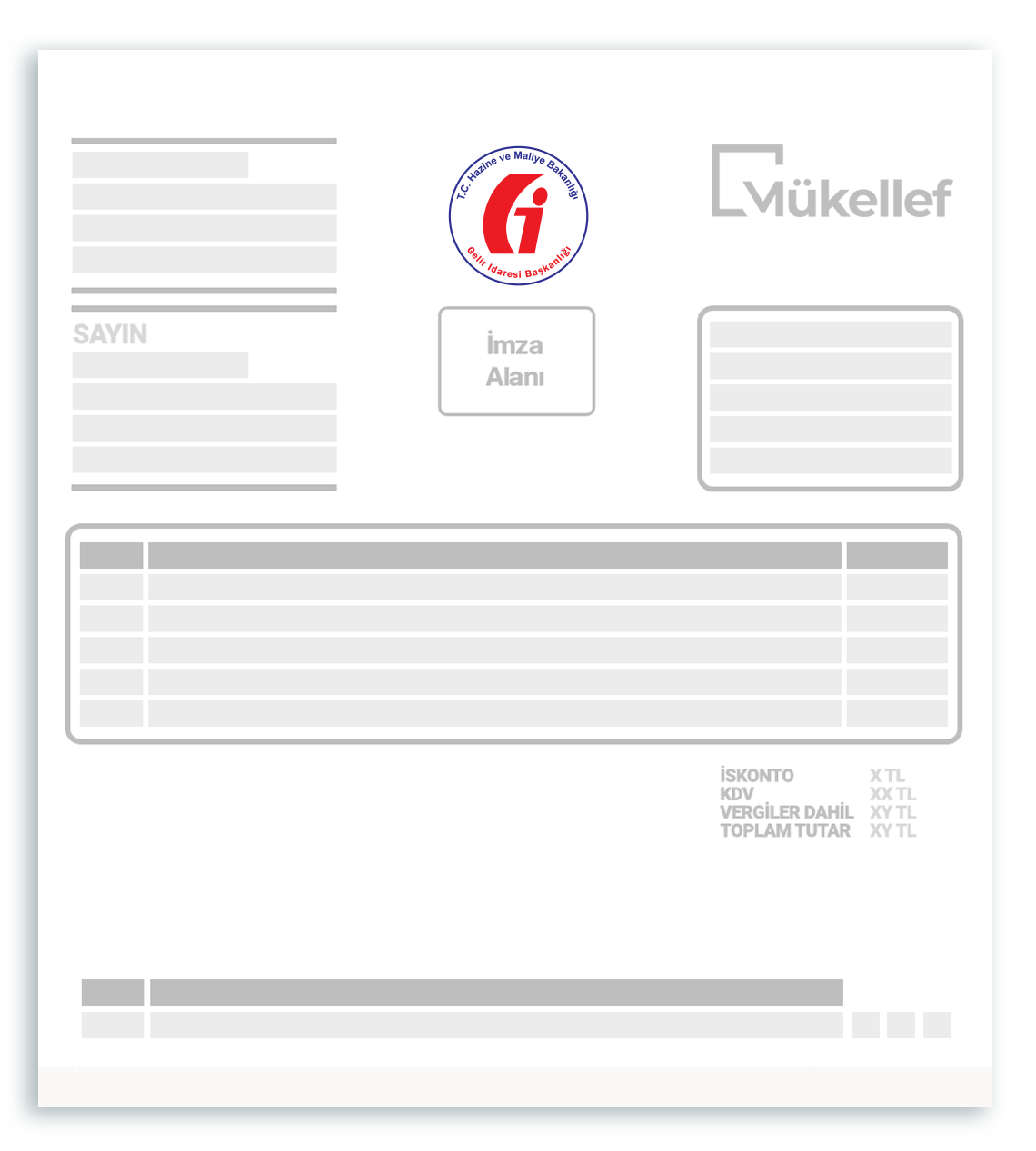

We can describe how Mükellef works in a simple flow. People wishing to become a taxpayer and issue invoices provide the necessary personal and business details to the platform. Then, they are assigned to one of the public accountants using Mükellef. All paperwork is completed online. The documents that should bear wet signature are collected by a courier and the public accountant incorporates the company. The taxpayer is able to use the bookkeeping software for free, issue invoices, record the costs and expenses by saving electronic screenshots of these and follow up the bank account activity. Mükellef users can use 100 e-invoices monthly for free and purchase more from the system if they wish. Public accountants draw the bookkeeping data and process them in their own accounting system.

Launched by Okan Şafak early this year, Mükellef carries on its business with a team of 5 people. Mükellef which has been under development for the last 3 months continuously gets new feature edits. Mükellef which has bookkeeping integration with Paraşüt has business partners such as Foriba, iyzico, GittiGidiyor, Scotty and Ideasoft.

One public accountant for each company

A company can be incorporated the next day via Mükellef when the papers are uploaded accurately to their system. Upon the delivery of documents with wet signature by Mükellef, e-invoice application is processed. The companies become able to issue invoices within 2-3 days depending on the processing speed of the Revenue Administration. In the week of its launch, around 50 public accountants applied to Mükellef and the company reached almost 50 customers. We would like to remind that there is practically one public accountant for each company.

Start-up which currently does not have any investment, charges taxpayers based on a monthly subscription model, and software use fee is collected from the public accountants for the taxpayers they manage by using the company's software. Prices vary based on the type of tax liability.

Target of reaching 6 thousand users by the end of the year

As a future objective, the company plans to make the declaration payments through the system, which is an unprecedented application in Turkey. Respective negotiations are proceeding with the Revenue Administration. Mükellef aims to reach 6 thousand users by the end of the year and these users will primarily consist of couriers. Followed by attorneys, public accountants, Youtubers and those who make sales through Instagram and anyone in need of issuing invoices may use the platform.

If you want to use Mükellef, you can apply by clicking this link.

Would you like to write the first comment?

Login to post comments